Related to Budget

- Policy Areas

- Policy Area

Displaying 41-50 of 103

Apr 10, 2024

Publication

Apr 10, 2024

Publication

Earlier today, the Fiscal Year (FY) 2025 budget development process officially moved to the Legislature with the release of the House Committee on Ways and Means (HWM) budget proposal. About two months after Governor Healey filed her administration’s spending plan, the $57.98 billion HWM budget…

Publication

Mar 18, 2024

Publication

Mar 18, 2024

Publication

On January 24th, the Healey administration filed its budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan is supported by tax, departmental, and federal revenues, as well as the use of trust fund resources built up in recent years.The revenue foundation for Governor Healey’s…

Publication

Mar 08, 2024

Publication

Mar 08, 2024

Publication

On January 24th, Governor Healey released her administration’s budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan included critical investments in childcare, healthcare, and transportation; as well as $20.3 billion in gross spending for the state’s MassHealth program.…

Publication

Mar 06, 2024

Publication

Mar 06, 2024

Publication

On January 24th, the Healey-Driscoll administration released its Fiscal Year (FY) 2025 budget proposal, with significant investments in childcare, education, and transportation. The $58.13 billion spending plan is a $2.1 billion increase (3.7 percent) over the FY 2024 General Appropriations Act (…

Publication

Feb 28, 2024

Publication

Feb 28, 2024

Publication

The Healey-Driscoll administration released its Fiscal Year (FY) 2025 budget proposal on January 24, 2024. The Governor’s budget proposes $58.13 billion in total on-budget spending including $1.3 billion in spending supported by income surtax revenues directed to education and transportation…

Publication

Feb 26, 2024

Publication

Feb 26, 2024

Publication

The Healey administration filed its Fiscal Year (FY) 2025 budget proposal on January 24th, totaling $58.13 billion. The spending plan includes critical investments in healthcare and education, as well as a notable funding increase for transportation supported by new income surtax revenues.Governor…

Publication

Feb 23, 2024

Publication

Feb 23, 2024

Publication

On January 24th, the Healey administration filed its budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan includes $1.3 billion in proposed spending supported by income surtax revenues, an increase of $300 million over the $1 billion surtax spending cap established for the FY…

Publication

Feb 14, 2024

Publication

Feb 14, 2024

Publication

On January 24th, the Healey administration filed its budget proposal for Fiscal Year (FY) 2025. The $58.13 billion spending plan included critical investments in child care, healthcare, and transportation; as well as sizeable increases in support for local aid to cities and towns and K-12 education…

Publication

Jan 24, 2024

Publication

Jan 24, 2024

Publication

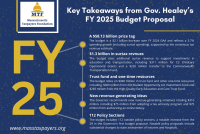

Earlier today, the Healey-Driscoll administration released its Fiscal Year (FY) 2025 budget proposal. The $58.13 billion spending plan includes critical investments in childcare, education, and transportation; and $1.3 billion in spending supported by income surtax revenues. The Governor’s budget…

Publication

Jan 11, 2024

Publication

Jan 11, 2024

Publication

Earlier this week, the Healey administration announced a $1 billion tax revenue shortfall for FY 2024, downgrading the revenue benchmark from $40.41 billion to $39.41 billion. They also released a plan to solve the shortfall which includes approximately $375 million in net mid-year (9C) budget cuts…

Publication