The Massachusetts Taxpayers Foundation said the most notable difference between the House and Senate versions of the ARPA spending proposal was the proposed timeline and process for providing premium pay to essential workers. “Like the Senate version, the final language creates a Premium Pay Advisory Panel to assist with program design,” the organization said in a summary of the bill. “However, the final version does not explicitly authorize the bonus payment to be provided as a tax credit, as the Senate proposed, and establishes a March 31st deadline for payments.”

December 09, 2021

FY 2022

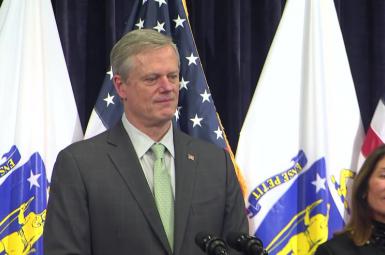

Baker sees “Red Tape” in premium pay panel

The Massachusetts Taxpayers Foundation said the most notable difference between the House and Senate versions of the ARPA spending proposal was the proposed timeline and process for providing premium pay to essential workers. “Like the Senate version, the final language creates a Premium Pay Advisory Panel to assist with program design,” the organization said in a summary of the bill. “However, the final version does not explicitly authorize the bonus payment to be provided as a tax credit, as the Senate proposed, and establishes a March 31st deadline for payments.”